Signed in as:

filler@godaddy.com

Signed in as:

filler@godaddy.com

We are being warned of a national debt growing “exponentially in perpetuity” and that this represents a financial burden for generations to come. We’re now spending our grandchildren’s future. Now, we may even be at our great-grandchildren, because it takes so long on this trajectory to pay it off.

Since the turn of the century, our national debt has nearly quintupled to around $27 trillion (representing a debt of $204,000 per household), and will continue to grow exponentially in perpetuity.

This debt really does impact Americans as individuals. Money you earn will go to pay interest to debtholders and China, and not your family.

Programs such as Social Security, Medicare, and Medicaid must be reformed to avoid draconian cuts and preserve these programs for those who need them. National defense investments must be prudent. Congress should reject wasteful federal programs, refuse to subsidize special interests, and eliminate the multiple layers of taxation currently imposed upon individual savings and investment.

The country will be failing future generations if it does not correct the current fiscal crisis.

We understand that future generations can’t sustain the level of debt that we’re growing at the moment. Most of us completely understand that we have to do more to get the economy back on track. But we can’t do it by damaging the financial viability of our country and future generations.

The coronavirus pandemic has exacerbated the fiscal strain on the country.

Even before the COVID-19 pandemic and its related economic fallout, America’s debt trajectory was on an unsustainable path. It has now reached a point of crisis.

Returning to a place of fiscal responsibility won’t be easy, but is something that is critical to achieve.

We have to make difficult choices. To take care of the country, we have to be good stewards of our finance.

Our country has to be governed by people who have, truly, the nation’s best interests at heart. And, you know, it takes real discipline to do that these days, especially when a growing chorus of voices says, ‘Spend as much money as you can possibly conceive.’ 7/30/2020

Here are two short comedy routines that communicate our society’s foolish economic situation as well as anything else we can show. Then a Harvard professor explains the bottom line.

1. Bank loan officer and debt limit. 3:08 https://www.youtube.com/watch?v=Li0no7O9zmE&feature=youtu.be

2. The doorbell. We need more money. 0:56 https://youtu.be/-1-JN7JvIeE

3. Harvard professor. How critical is religion to democracy? 1:38

Optimists like us strongly believe in the foundation of free enterprise and capitalism that our economy is built on. We believe that the spread of opportunity to more of the world will not only grow their economies, but ours as well. But the American prime breadwinner jobs market has shrunk since the 2001 peak.

The Federal Government has promised far more than it can deliver.

Improvements will be painful.

Soon after Social Security started in 1935, the 3-legged stool metaphor began. Americans need a new 3-legged stool. Start an ongoing income today that would provide you with more financial security.

Slide 1 of 8: YOUR PARENTS THREE-LEGGED STOOL FOR RETIREMENT. Most people used to work until they couldn’t work any more, then moved in with their kids or went to the County poorhouse. Now we have had a generation of Americans who have enjoyed a retirement where they could relax and not work -- using a combination of 3 incomes. Soon after Social Security started in 1935, the 3-legged stool metaphor started being used. Retirement meant putting your feet up and relaxing at age 65 on your government Social Security, your company pension check, and your personal savings. Of course in 1935 the average man only lived to age 63, rather than today’s 80 plus. If future Social Security were to be rebased to how it was originally intended, benefits would start at age 85, not the present age 67. The other 2 legs of the stool, pension and personal savings have already shrunk to provide only 33% of today’s retiree income. Most Americans need a new 3-legged stool.

Slide 2 of 8: SOURCES OF RETIREMENT INCOME (All retirees aged 65 and over, Social Security data). Today's reality shows that the pension leg and savings leg of the traditional 3-legged stool have already combined to just be one leg at 31%. A new support leg is emerging; continuing to work to earn income past age 65 already gives today’s retirees 32% of their income. A part time job at Wal-Mart at age 70 helps many people today, but starting earlier to develop more entrepreneurial skills would be a better solution for many people.

Slide 3 of 8: Since June of 2016 the growth has climbed back up over 3% in 2018! But going forward the U.S. is expected to see only 20% of GDP growth annually come from labor force expansion. 80% of our expected growth will come from productivity. We have 6.8 million unemployed (18 year low) but 6 million open jobs (a record high) where employers can’t find high-skilled qualified applicants. Second, many homes and mortgages that are currently under water will remain so for many years. Third, ballooning government debt and obligations, both federal and local, is further slowing economic growth –taking more than a point of GDP growth off the economy annually. There is no simple route out – and as we prepare for the tidal wave of entitlement spending in the years ahead, we can only expect that the hard choices we face will get even harder. Taken together these three headwinds make the delicate act of emerging from the 2008 recession all the more precarious.

Slide 4 of 8: As you can see, the Federal Government has promised far more than it can deliver. No matter who fixes the obvious problem, the changes will be painful. The Social Security money (shown in green) taken out of people’s paychecks for over 85 years has all been spent. Nothing has been saved. Health care (shown in blue) is an emptier promise. Our rapidly rising debt (interest shown in red) will have to be paid by our children or grandchildren. All other government programs, such as National Defense, are projected towards zero in the lifetime of today’s 60 year olds. Most Americans don’t understand our situation.

We need to listen to him

Slide 5 of 8: The Europeans recently asked China to help them bail out Greece and solve their problems. China’s answer is reality. Europe should listen, so should the U.S. Most importantly - - you and I should listen and heed this wise advice.

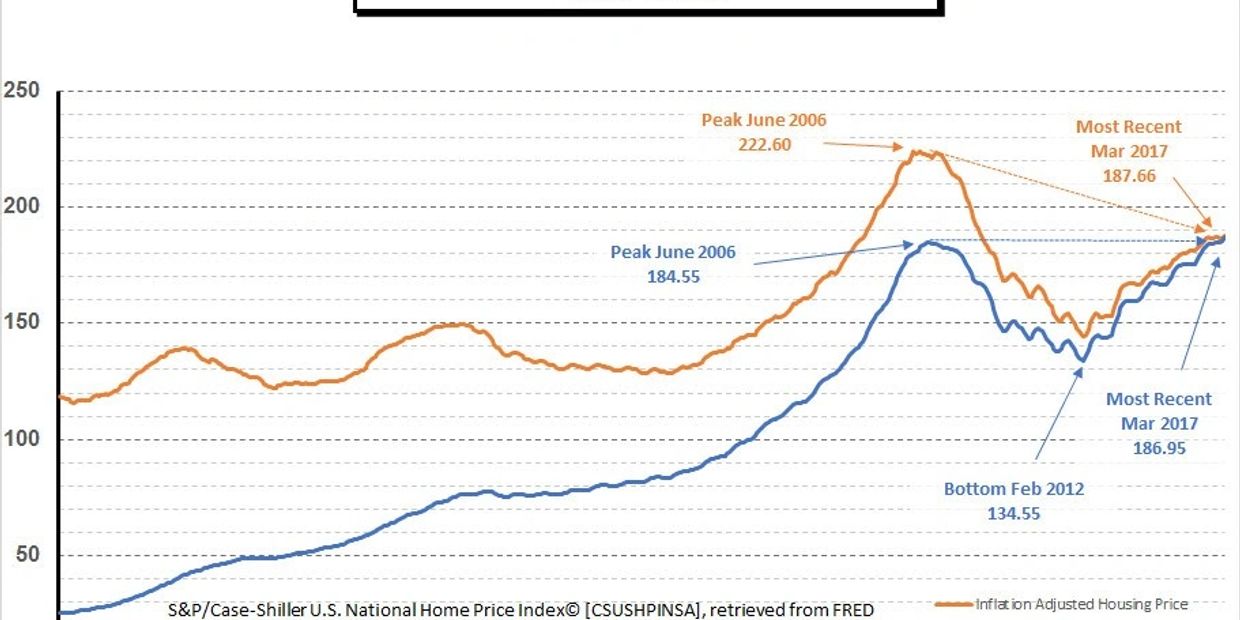

Slide 6 of 8: The housing bubble that started around 1999 has hurt the recent buyers who find themselves upside down. The long term good news is that the nominal home price has increased from $25,000 in 1970 to $187,000 today; and its value is back on the upward rising, inflation-adjusted, pre-bubble trend line. Homes over the long term, just like stocks, can be good investments. Many people who lack a savings plan or discipline have still ended up with equity in their home at the end of their lives.

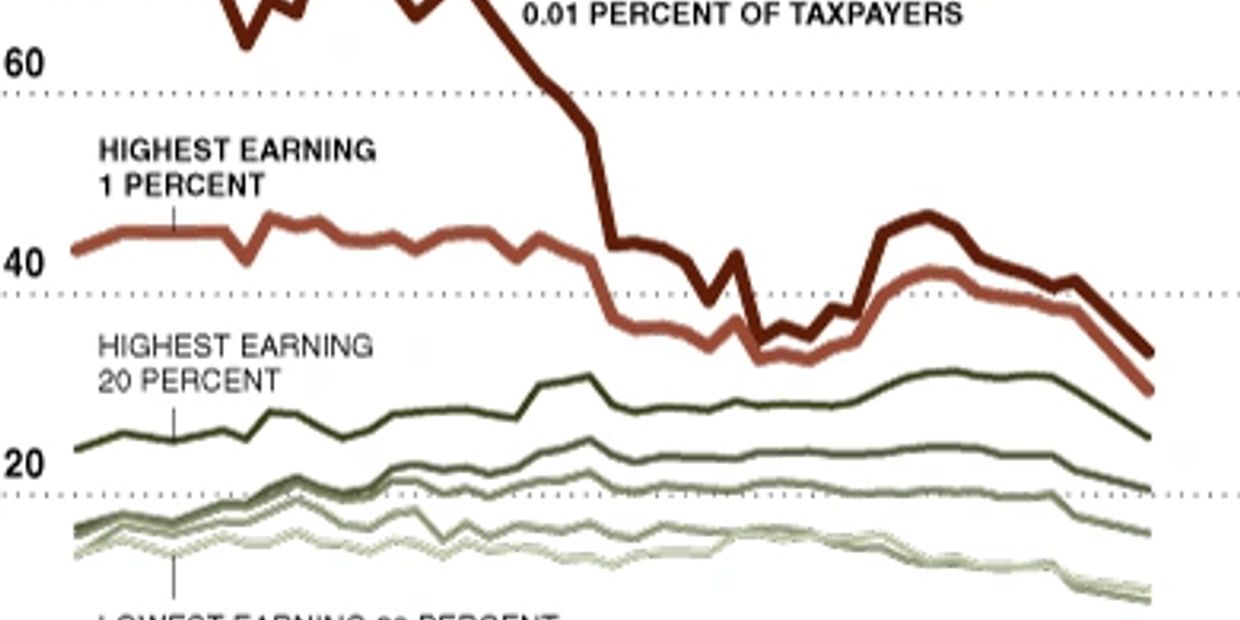

Slide 7 of 8: Tax rates right now are the lowest in over 60 years. Given this and all our future government obligations, there will be incredible political pressure to raise them again, despite the fact this will hurt jobs and the economy. Future tax hikes will probably be more heavily placed on high income earners. State and local taxes (governments that can't run deficits) will continue to rise for everyone. Expect that your tax rates will rise as politics, inflation, or your own productivity bring you up into higher brackets. Any possible tax deductions you can find will be most helpful as you plan your financial strategy.

Our suggested three-legged stool

Slide 8 of 8: If you are planning on retiring early, you won’t have Social Security yet. Here is what we now suggest for many people. Leg one - pay off your home. Leg two - savings. Delaying can significantly reduce your results. For example: if you begin saving just $100 a month at age 25, then at a 7.5% annual rate of return you will have $304,272 when you are 65. If you wait to begin saving at 35, you will have only $135,587 at age 65. Bottom line is to have a solid savings plan going into the future. Leg three – ongoing income. Rather than starting that part time job after you retire, consider starting a part time business of your own now that could develop into an ongoing income that would provide you with more financial security. Your savings discipline and your entrepreneurial adventure will both benefit from starting as early in life as possible and doing the right thing for you. You don’t have to know everything to do something. You can start today.

Soaring federal debt risks 'fiscal crisis,' Congressional Budget Office (CBO) warns

By Caitlin Emma 06/25/2019 10:10 AM EDT

Federal debt held by the public is already sky high and it’s expected to soar during the next 30 years if current laws remain unchanged — dramatically escalating the risk of a “fiscal crisis,“ the CBO said in a new report Tuesday.

Debt held by the public is projected to rise from 78 percent of gross domestic product this year to 144 percent by 2049, according to long-term budget projections released by CBO.

The agency noted that such debt over the last 50 years has averaged 42 percent of GDP, exceeding 70 percent during only one other period in U.S. history — after the “surge in federal spending that occurred during World War II."

CBO’s projections not only assume that current laws stay in place, but that benefits through federal safety net programs like Social Security and Medicare are paid in full even if the programs are nearing or have reached insolvency.

If the U.S. stays on this path, economic output would suffer over time, the agency said. That path would also “increase the risk of a fiscal crisis — that is, a situation in which the interest rate on federal debt rises abruptly because investors have lost confidence in the U.S. government’s fiscal position.”

Higher interest costs, driven by a major increase in federal borrowing and higher interest rates over the long term, are key drivers of the country’s long-term budget woes, said CBO Director Phillip Swagel. Other significant drivers are an aging population, rising health care costs and greater federal spending on Social Security and Medicare.

The agency’s projections could vary greatly depending on how Congress acts on fiscal policy. For example, if Congress prevented $126 billion in sequestration cuts next year and an increase in individual income taxes in 2026, debt held by the public would be even higher, reaching 219 percent of GDP in 30 years.

The negative consequences of excessive debt include higher interest rates; slower income growth; large debt service payments; a reduced ability to respond to future recessions, emergencies or opportunities; a heightened dependency on foreign borrowing; further burdens on younger and future generations, and an increased risk of a financial, inflation, or other type of fiscal crisis.

Yet, numerous pervasive myths create the impression that these consequences do not exist, including:

· Low interest rates mean there is no cost of borrowing.

· Like after World War II, it will be easy to reduce debt after the pandemic.

· The Federal Reserve can keep buying our debt without consequences.

Myth #1: Low interest rates mean there is no cost of borrowing.

While low interest rates reduce the fiscal cost of debt today, they do not eliminate this cost. Rather, they shift costs to the future. Borrowing increases the government’s total stock of debt and debt service payments. Without a plan to pay down that principal, it will almost certainly be rolled over into further debt at higher interest rates. Interest rates may remain low for some time, but they are practically guaranteed to rise from current levels. Higher debt also makes the country more vulnerable to any future interest rate increases or spikes – while interest rates can change quickly, debt reduction takes time.

Myth #2: Like after World War II, it will be easy to reduce debt after the pandemic.

Unfortunately, there is no reason to expect a similar decline after the current crisis; rather, projections suggest debt will continue to grow rapidly as a share of GDP. Two factors allowed the United States to quickly shed its massive debt burden after World War II: near-balanced budgets and rapid economic growth.

Myth #3: The Federal Reserve can keep buying our debt without consequences.

While the Federal Reserve does not purchase debt directly from the U.S. Treasury, the fact is it pays for this debt by essentially adding to the money supply.

It is unlikely the Federal Reserve would or could continue purchasing debt at its recent pace, since efforts to do so could have serious adverse consequences.